The Santa Paula High School Cardinal Track and Field team concluded their season Thursday, May 1 with a strong showing at the Citrus Coast League Finals.

Hello all. I hope you’ve been enjoying the rain and the relief it’s bringing us. Here’s to a continuing prosperous and healthy new year!

When you retire, some of your expenses may go down – but health care is not likely to be one of them. In fact, your health care costs during retirement may well increase, so you may want to plan for these costs well before you leave the work force.

International Women’s Day, observed on March 8, celebrates the social, cultural and political achievements of women. Yet, women continue to face many challenges. For one thing, women still encounter gender-specific obstacles to their important financial goals, such as a comfortable retirement. If you’re a woman, what can you do to get past these barriers?

International Women’s Day, observed on March 8, celebrates the social, cultural and political achievements of women. Yet, women continue to face many challenges. For one thing, women still encounter gender-specific obstacles to their important financial goals, such as a comfortable retirement. If you’re a woman, what can you do to get past these barriers?

Last year, Americans spent more than $19 billion on Valentine’s Day gifts, according to the National Retail Federation, with the majority of this money going to flowers, candy, cards and an evening out. These gifts were thoughtful, of course, and no doubt appreciated, but they were also somewhat disposable, for want of a better word. On the other hand, some financial gifts can have a pretty long “shelf life.”

If you’re just starting out in your career, you will need to be prepared to face some financial challenges along the way – but here’s one that’s not unpleasant: choosing what to do with some extra disposable income. When this happens, what should you do with the money? Your decisions could make a real difference in your ability to achieve your important financial goals.

As an investor, your main goals will change at different times in your life. During your working years, you need to grow as many resources as possible for retirement. Once you retire, however, you will likely need to focus more on getting income from your investments. But what are your options?

Greetings and Happy New Year! I hope that all your endeavors, personal and business, are rewarding in the upcoming year.

We’re just about ready to open the door to 2017, so you might be thinking about some New Year’s resolutions. What’s on your list this year? More visits to the gym? Learning a new language? Mastering the perfect beef bourguignon? All worthy ambitions, of course, but why not also include some financial resolutions?

If you are a “millennial” – a member of the age cohort born anywhere from the early 1980s to the late 1990s – then you’re still in the early chapters of your career, so it may be a stretch for you to envision the end of it. But since you do have so many years until you retire, you’ve got the luxury of putting time on your side as you save and plan for retirement.

By Chris Wilson, School Board President, Santa Paula Unified School District

We’re at the end of another school year. If you have younger kids, you might be thinking about summer camps and other activities. But in the not-too-distant future, your children will be facing a bigger transition as they head off to college. Will you be financially prepared for that day?

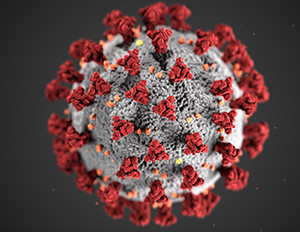

Hello friends and associates. The old saying goes “April showers bring May flowers.” Let’s hope that old adage holds up and we get some adequate rains to SoCal! This session I want to visit an issue that’s currently on the front pages, IT speaking, right now. We provide our information we share from experience, web site/tech site references, etc.

If you’re at the beginning of your career, you might not be thinking too much about the end of it. But even younger workers should be aware of – and saving for – their eventual retirement. And since you’ve got many years until you do retire, you’ve got a lot of options to consider – one of which is whether an IRA may be appropriate for you and, if so, what type.

For many people, the concept of retirement can be scary, both emotionally and financially. If you, too, feel somewhat anxious about what awaits you, you might feel more comfortable in knowing that, depending on where you work, you might be able to retire in stages.

A taxpayer who needs more time to complete his or her 2015 individual tax return can request an automatic six-month extension. The extension is obtained by filing IRS Form 4868 on or before the April 18, 2016 deadline.

As an investor, you may be gaining familiarity with the term “market correction.” But what does it mean? And, more importantly, what does it mean to you?

Americans spent nearly $19 billion in Valentine’s Day gifts last year, according to the National Retail Federation. Much of this money went for gifts with short shelf lives, such as candy, flowers and restaurant meals (and about $700 million was spent on gifts for pets). There’s certainly nothing wrong with giving chocolates or roses. But this year, think about going beyond the classic gifts. Instead, use Valentine’s Day as an opportunity to determine how you can make gifts with long-lasting impact to your circle of loved ones.

Happy New Year to all! Here’s hoping your personal and business endeavors for 2016 are rewarding and successful.

A taxpayer’s filing status for the year is based upon his or her marital status at the close of the tax year. Thus, if you get married on the last day of the tax year, you are treated as married for the entire year. The options for married couples are to file jointly or separately. Both statuses can result in surprises for individuals who previously filed as unmarried. The surprises can be both pleasant and unpleasant.

Hello friends and associates – Happy Holidays! This session I want to visit security, in a different fashion, more directed to ‘protecting your security’. It’s an ongoing problem worth attention and vigilance.

Well it seems we may finally be getting some fall weather in the Heritage Valley! As the season turns and the leaves begin to fall another year-end approaches. Around the end of the year I always think ‘maintenance’. It’s something that has just become part of my natural thought process over the years being in the computer support arena. Here’s what I mean.

You’ve no doubt heard about the risks associated with investing. This investment carries this type of risk, while that investment carries another one. And it is certainly true that all investments do involve some form of risk. But what about not investing? Isn’t there some risk associated with that, too?

Maybe you already have an email client (service) – this is probably true. If you do, maybe you’re thinking of changing. And yet, maybe you’re a ‘newbie’ and don’t’ have email and would like to have one but really don’t know where to start. I’ve hit on these items in my sharing of information in the past but it’s worth revisiting, particularly for anyone who missed it. Let’s share some views on the general terms and definitions that might help you navigate this path. Please keep in mind there are details/options here and there than can be tweaked with all the different options - the goal here is to just give you a general overview.

October 3, 2015 ushers in new laws and rules to protect homebuyers from being duped or acting without being informed. There are new forms replacing old forms and new timelines designed to slow down the purchase process. The rules apply only to transactions beginning October 3 or later.